As we discussed in our previous article, the supply portion of your electricity rate is made up of several key components: ancillary, transmission, capacity, and generation/energy. Understanding each of these components is crucial for effectively managing your overall electricity costs. However, today’s focus is on a significant event that has recently taken place—the PJM Capacity Auction—which could have a substantial impact on your energy costs. This article aims to provide you with a clear understanding of what happened, why it matters, and what it could mean for your business.

What is the PJM Capacity Auction?

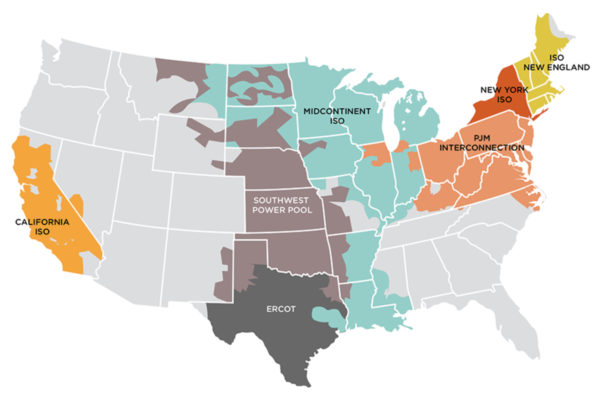

The PJM Capacity Auction is a critical planning process where electricity suppliers secure the necessary resources to ensure there will be sufficient power available, especially during times when demand is high, like hot summer days. This auction, conducted by PJM Interconnection—the organization responsible for managing the electricity grid across 13 states (DE, IL, IN, MD, MI, NJ, NC, OH, PA, TE, VA, WV, KY) and the District of Columbia—resulted in record-high-capacity prices. Capacity rates and tags are key parts of your electricity costs. A capacity tag reflects the amount of electricity your business is expected to use during peak demand, typically measured during the highest demand hour of the year. These rates are set through capacity auctions, where providers secure resources to meet future demand. The cost is then passed on to consumers, based on their capacity tag.

What Happened in the PJM Capacity Auction?

In the most recent auction, capacity prices increased dramatically, reaching $269.92 per megawatt-day (MW-day), up from $28.92/MW-day in the previous year. This sharp rise is noteworthy because it will impact the cost of electricity for consumers, including businesses. The auction secured 146,570 MW of capacity for the 2025/2026 delivery year. However, the extra cushion of power available, known as the reserve margin, decreased to 18.5% from 20.4% in the previous year. This reduction raises concerns about the availability of sufficient resources during peak demand periods.

Key Factors Driving the Price Increase:

Several factors contributed to the significant rise in capacity prices:

Generator Retirements: Many older power plants have been retired, reducing the overall supply of electricity. Approximately 6,600 MW of generation capacity was removed from the market, contributing to the higher prices.

Increased Demand: The forecasted peak demand for electricity in the PJM region has risen, putting additional pressure on the available supply. For the 2025/2026 delivery year, the peak load forecast increased to 153,883 MW from 150,640 MW.

Regulatory Changes: Recent changes approved by the Federal Energy Regulatory Commission (FERC) have introduced new methods for predicting extreme weather risks and updated how we measure the reliability of different power sources. These changes aim to give a more accurate picture of how reliable each power source will be during periods of high demand.

Local Constraints: Certain areas within the PJM region, such as the Baltimore Gas and Electric (BGE) and Dominion zones, saw even greater price increases due to local power supply shortages and transmission constraints. These elevated prices indicate a need for additional resources or infrastructure improvements in these areas.

Implications for Your Business

Understanding the outcome of this auction is crucial because it will likely impact on your business’s energy costs. As we’ve previously discussed, the supply rate of your electricity includes several components, with capacity cost being one of them. Given the increase in capacity prices, even if all other factors remain constant, you could still see a rise in your overall electricity rate due to this component.

Here’s what you could consider:

Higher Energy Costs: The increase in capacity prices means that the cost of electricity is likely to rise, particularly in regions with local constraints like BGE and Dominion. For example, a business with a 1 MW (1,000 kwh) capacity tag could see its annual costs rise significantly, potentially affecting overall operating expenses.

Strategic Considerations: While the immediate impact is higher costs, these price increases also reflect broader trends in the energy market, such as the need for new generation capacity. This could be an opportunity to evaluate your energy strategy, including options for on-site generation or energy efficiency improvements, to better manage future costs and reliability concerns.

Long-Term Perspective: The high prices in this auction may encourage investment in new energy resources, which could help stabilize or reduce prices in the long run. However, the pace of new generation construction is currently slow, facing challenges like financing and regulatory hurdles.

The recent PJM capacity auction highlights the ongoing challenges and emerging opportunities in the energy market. Gaining insight into the factors driving these changes is essential for making informed decisions about your energy strategy.

At Sunlight Energy Group, we are committed to keeping you well-informed and equipped to manage your energy needs effectively. To arrange a meeting with your dedicated account representative, please click here.