The ongoing conflicts in Ukraine and Israel has reverberated across global geopolitical landscapes, leaving no sector untouched. Among the many sectors impacted, the energy market stands as a focal point, witnessing significant shifts and disruptions. As the conflict persists, its ramifications extend far beyond the borders of Eastern Europe and the Middle East, directly influencing the dynamics of US energy markets. In this article, we are going to explore how these geopolitical conflicts of war have affected our energy markets at home.

The Russian-Ukrainian War’s effect on US energy markets

Europe’s heavy reliance on Russian natural gas has put the region in a vulnerable position amidst the conflict. As European nations seek to diversify their energy sources, the US has stepped in as the alternative supplier. This shift has caused a record-high in US liquefied natural gas (LNG) exports to Europe, contributing to tighter domestic supplies and impacting prices at home in 2022. During Russa’s invasion of Ukraine in February 2022 according to the NYMEX monthly settlement prices we saw prices reach as high as $9.35 in September 2022 compared to $4.37 in September 2021.

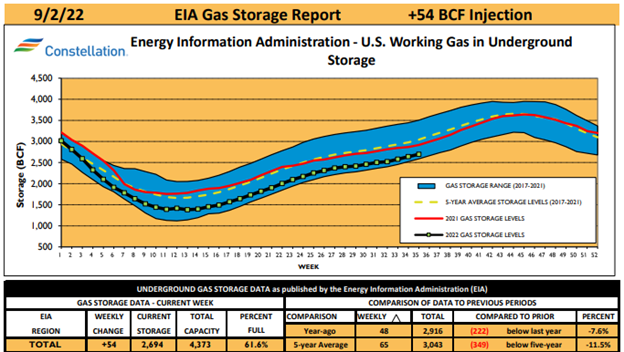

In 2023 the United States continues to lead the charge in LNG exports to Europe. According to the EIA U.S. exports averaged 11.6 billion cubic feet per day (Bcf/d) during the first half of this year, which is 4% (0.5 Bcf/d) more than in the first half of last year. However, in contrast to last year, gas storage levels are at a much healthier level as displayed in the following graph.

In 2023 the United States continues to lead the charge in LNG exports to Europe. According to the EIA U.S. exports averaged 11.6 billion cubic feet per day (Bcf/d) during the first half of this year, which is 4% (0.5 Bcf/d) more than in the first half of last year. However, in contrast to last year, gas storage levels are at a much healthier level as displayed in the following graph.

The United States continues to produce and export at record levels amidst the conflict. However, as European countries have found alternative energy suppliers away from Russia the US has taken a lot more natural gas into underground storage. With healthier natural gas storage levels, robust natural gas production, and a warmer than expected winter season natural gas prices have experienced a consistent decline due to these factors. Based on the NYMEX monthly settlement prices December prices fell to $2.71, down from $3.16 in November.

The Israel-Hamas War’s effect on US energy markets

On the other hand, amidst the continuing tensions in the Middle East with Israel and Hamas, the global oil markets experience continued volatility. Overall oil prices have risen about 6% since the start of the conflict. The Middle East is responsible for about a third of the global oil exports and an escalation of these conflicts could impact oil prices greatly. While gas prices domestically in the United States have not experience significant movement from this conflict it is still a possibility markets can begin to experience an increased volatility if conflicts escalate into farther regions of the Middle East, especially into larger oil producing members of OPEC. If oil prices rise the cost of transport would also increase which can concurrently increase the cost of transporting commodities like LNG.

In conclusion, while the direct impact of the conflict on US energy prices may not mirror the situation in Europe, the interwoven nature of global energy markets illustrates how geopolitical tensions, supply uncertainties, and changes in demand for various energy sources can collectively influence domestic pricing. This interdependence underscores the intricate balancing act that defines the US energy sector within a dynamic and interconnected global landscape. Our buffer against surging energy prices has hinged on the sustained period of warmer-than-usual weather and the anticipated extension of these conditions into the upcoming winter. Yet, this reliance on an atypical climate remains precarious; a sudden reversal to colder temperatures could swiftly erase this reprieve, plunging us back into the throes of escalating energy expenses.